Markets continue to climb a wall of worry shaking off political noise of which there was plenty in September! In a turbulent few days in the middle of the month Japan’s Prime Minister Shigeru Ishiba resigned, France’s Prime Minister Francois Bayrou, was ousted (leading to Sebastien Lecornu, the fifth French Prime minister in 2 years being appointed). And of course British Deputy Prime Minister Angela Rayner was forced to resign. All which investors largely ignored, but the month ended with more significant political turbulence in the US as the Republicans and Democrats failed to agree spending plans leading to the first Government shut down since 2018 as the quarter ended.

Away from political shenanigans, probably the most important event for investment markets was the US Federal Reserve making the first rate cut of the year (by 0.25%) in September. The Fed had been standing firm despite the pressure from Trump as the US economy has so far proved resilient in the face of tariffs. Q2 US GDP Growth was recently revised upwards to 3.8%, the strongest quarter for over two years. But at the same time US inflation remains elevated and the Core PCE inflation reading for August was 2.9%, well above the Fed’s target of 2%. However, the Fed has probably responded to a weakening in the labour markets with only 22,000 jobs added in August, well below estimates. Another two US rate cuts are being priced in for 2025 with economists predicting a slowdown in the second half of the year. But this still doesn’t appear to be enough for Trump who posted an AI image on his social media platform of him firing Fed Governor Jerome Powell!

The UK and Europe didn’t follow suit keeping rates on hold in September. The ECB has been ahead of the curve and with Eurozone rates down at 2% they have effectively said that’s it for now. The Bank of England find themselves in a trickier position. as Britain's economy slowed in the second quarter of 2025 to just 0.3%. But inflation still confounds and the latest official reading of 3.8% calls into question whether there is room for further rate cuts this year with markets now pricing in one more 0.25% rate cut by April 2026.

There is little economic cheer in the UK. The boast of being the fastest growing economy in G7 in the first half of the year reminds of the adage that 'in the Kingdom of the blind the one-eyed man is King'. It appears that stringent tax rises could be on the agenda in the Autumn budget to help plug the widening deficit and further stifling growth. But despite the political turbulence and economic malaise in the UK, the FTSE has been on a storming run having had the best quarter since 2022. A timely reminder that the UK stockmarket and economy are not aligned. Over 80% of revenues from the FTSE 100 come from overseas, whilst even the mid-cap FTSE 250 index has over half revenues from overseas.

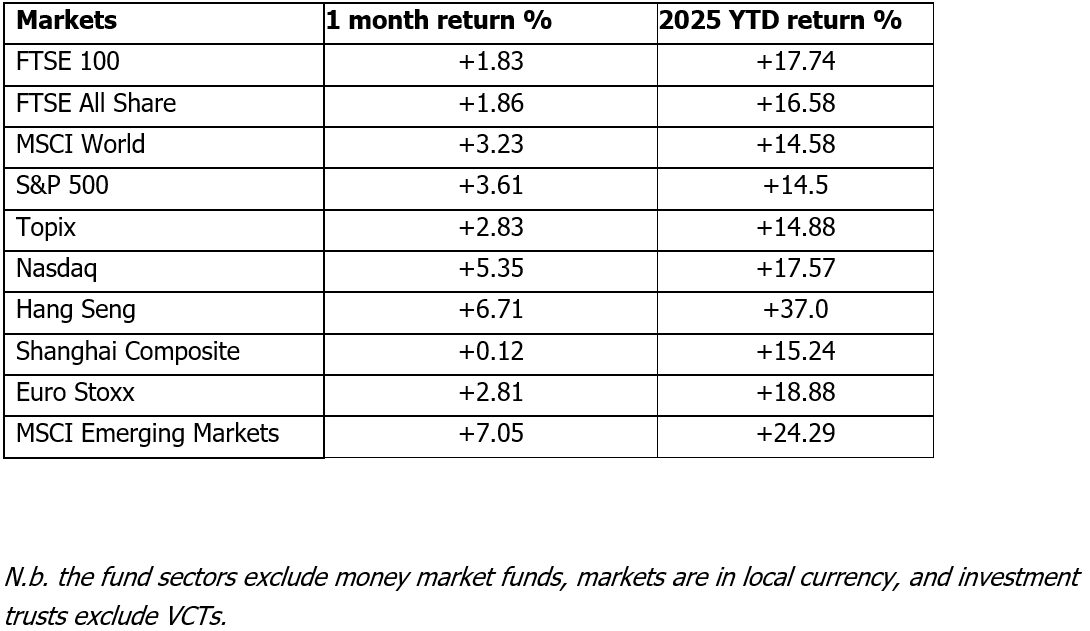

The “risk on” mood continued across global stockmarkets in September with the MSCI World Index posting a monthly gain of 3.2%. Unlike in the Ryder Cup, the US outperformed in September with the S&P 500 up by 3.6%. The first rate cut of the year and comments about further rate cuts from various sources fuelling optimism. Jerome Powell is trying to temper the exuberance and was quoted last week as saying stocks are “fairly highly valued". Is he signalling a sell? The S&P hit yet more dizzy new heights in September as did the Nasdaq. Interestingly Goldman Sachs released research into what has driven US markets over the last two months, and it’s been speculative areas such as quantum computing, bitcoin sensitive equities, and non-profitable tech. With the US government shutting down due to budget quarrels the last quarter of 2025 is set for an inauspicious start so will the rally continue?

Investors in Japan seem sanguine over the change of political leadership and the Nikkei also reached a new record high in September. The FTSE 100 didn’t manage to breach the August record but was up 1.8% to compound some impressive returns year to date. However, it is Asian and emerging markets that continue to set the pace. MSCI Asia Ex Japan and the MSCI Emerging Markets indices posted monthly gains of 7%. Both areas have significantly outperformed global equity benchmarks year to date, with dollar weakness providing a strong tailwind. For investors seeking long-term growth Asian and emerging markets can certainly offer an appealing alternative for those seeking diversification from US exposure and low growth across other developed economies.

Bond markets were largely flat in September, the Bloomberg Global Aggregate Bond index was up marginally by 0.65%. UK borrowing costs hit a 27 year high in September with the 30-year gilt rising to 5.7% but despite volatility at the longer end of the curve the ten-year gilt was largely flat, starting the month yielding 4.72% and ending at 4.7%. After the US rate cut it was no surprise to see a hardening of prices in the US bond market with the ten-year treasury going from a yield of 4.23% to finish yesterday at 4.15%. The ten-year JGB inched up marginally and now offers 1.64%.

Turning to commodities and gold continued the astonishing run seen in recent times. An ounce of gold hit new all-time highs again and closed the month with an ounce costing $3873 up from $3518 at the start of September. Political turbulence, concerns of ongoing dollar weakness and falling rates reducing the opportunity cost of holding the precious metal all providing momentum. Elsewhere the oil price was range bound and a barrel of Brent crude ended a dollar down to close at $67.02.

In currency markets it was a nothing month with the US rate cut throwing up no surprises. Sterling rose marginally against the Yen but fell 0.83% versus the Euro and 0.32% against the US dollar.

Turning to funds now and remarkably every IA fund sector was in profit last month, admittedly the worst performing only gained 0.01%, but a profit is a profit! Looking at the best performing funds first and there was only one story when looking at individual funds, gold. Every fund in the top ten performers was either a pure gold fund or a gold and precious metals one. With gold over $3800 an ounce it isn’t really a surprise to see gold miners finally joining the party and many fund managers think they are still good value. With more US rate cuts on the cards and political tension in many countries will gold continue its ascent? Baker Steel topped and tailed top ten with their Gold & Precious Metals fund hitting the heights with a gain of 29.8%.

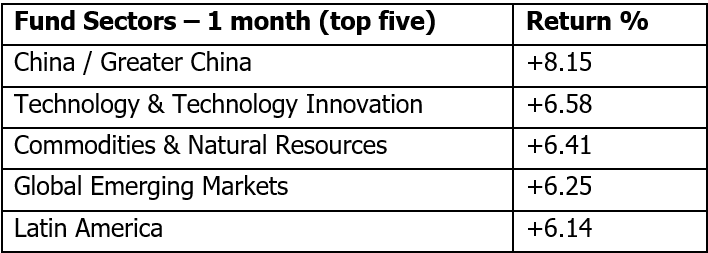

From a sector perspective the story was slightly different primarily as gold doesn’t have an individual sector. China topped the sector charts continuing the excellent run of 2025. Indeed, going back to index performance and the Hang Seng is up 37% in 2025. The IA China and Greater China sector gained 8.1% on continued hopes that the worst of the Chinese property correction is in the past and that Beijing’s stimulus measures are starting to encourage consumption. The Global Emerging Market sector also featured in the top five last month after China’s showing as well as a good performance from Latin America (benefiting from commodities and a weak dollar).

At the foot of the tables JPM Emerging Europe propped the pack after summer optimism over an end to the Russia Ukraine war petered out. The fund fell 10.9%. The remainder of the top ten was a mixed bag with a loose theme of food emerging as a problem area. Pictet Nutrition, Allianz Food Security and Baring Global Agriculture all featured in the bottom ten. It is also interesting to note two prominent “quality growth” funds are in the bottom ten, Lindsell Train UK Equity and Trojan Global Income. From a sector perspective European Smaller Companies propped the pack up gaining 0.01%.

Looking at investment trusts and four of the top five performers were commodity related with Golden Prospect Precious Metals topping the charts with a gain of 30%. The outlier was Petershill Partners being taken private after trading at a huge discount for a number of years and gained 28.99% in September – another one bites the dust! Just outside the top five sat the two main biotech trusts, International Biotech and Biotech Growth, both benefitting from renewed M&A in the sector.

Although flows remain negative into UK equity funds from domestic investors, international investor inflows are turning positive, and UK fund managers we speak to are optimistic the rally has further to go. Artemis highlighted that the UK remains the cheapest of all developed markets. Whilst value managers at MAN believe that cyclical stocks look cheap and are the current focus for new opportunities.

Another area where we are hearing bullish outlooks from fund managers this month is Asia. Managers from Fidelity, Stewart Investors and MAN all seeing a positive outlook for Asia overall and discussing how if the US dollar weakens further and rates fall, the region will benefit significantly.

Monthly performance figures 31/8/25 to 30/9/25 and YTD 31/12/24 to 30/9/25 source FE Analytics.

Important Information

This document is produced by Fairview Investing Ltd, an independent research consultancy. The content is for information purposes only and does not constitute financial advice. The commentary or research provided do not constitute a personal recommendation to deal. Any statements, opinions, forecasts, and figures are made by Fairview Investing (unless otherwise stated). They are considered to be reliable at the time of writing but may be subject to change.

Fairview Investing accepts no legal responsibility or liability for the content of this material. The contents of the document are not to be re-produced or circulated without the express permission of Fairview Investing Ltd. Fairview are independent investment consultants sitting on the Investment Committee of EXE Capital Management.