October saw another positive month across most markets as the data continues to point to a soft landing for the global economy, supported by falling interest rates. We continue to operate in an environment that befits the adage of a rising tide lifting all boats, as investors ignore political noise and focus on corporate and economic fundamentals.

The US economy is “holding up” according to the IMF and although they predict growth will slow to 1.9% in 2025 there is no sign that a recession is incoming. The latest US inflation reading came in below expectations at 3% and the Federal Reserve cut interest rates by 0.25% (to a range of 3.75-4%) for the second month in a row, with a slowing labour market proving a more immediate concern than above target inflation. With the Government shutdown still in place, a lack of economic data is making it difficult to have a clear picture as to whether this will be the last cut of 2025, but markets continue to price in US interest rates being around 3% by the end of next year.

Like the US, China is also seeing a slowdown with growth, but the annualised 4.8% growth for the third quarter proved better than expected. The US / China summit between Presidents Trump and Xi at the end of the month provided respite in the trade war between the two largest economies with a one-year truce agreed and an agreement to postpone restrictions on rare earth materials and semi-conductors.

At home, all eyes are on Rachel Reeves to see how she can balance a rapidly deteriorating fiscal situation in November’s budget. There will undoubtedly be more tricks than treats with speculation rife about which taxes will rise and whether Labour will break their manifesto promises especially around not raising income tax (which many economists believe to be the only real option to raise necessary funds). There was some good news with the IMF predicting the UK will have the second highest rate of economic growth in the G7 in 2025 - albeit a miserly 1.3%. But the UK will also have the highest inflation in the G7 – in October inflation remained stable at 3.8% despite predictions of 4%. A rate cut by the Bank of England in November is not off the table although a wait and see approach until after the budget seems likely.

One political change of note was in Japan where Sanae Takaichi became their first female leader in 2000 years, having managed to secure a small majority in the Conservative party leadership contest. An ex-TV host and heavy metal drummer, Takaichi is a fan of Thatcherism and Abenomics and already proving a hit with the investors. The Japanese market hit a new all-time high in October on expectations of her introducing a supportive economic stimulus package.

Turning to markets now and it was a record-breaking month across many global stockmarkets with new all-time highs in many indices including the FTSE, Nasdaq, S&P, Nikkei, Dax, Cac 40 and the Korean Kospi. The MSCI World Index posted a monthly gain of 2.6% as investors remain bullish.

The AI revolution continues to dominate the US stockmarket gains and Nvidia became the first company to have a value of $5 trillion, whilst Microsoft powered through the $4 trillion market cap level. Google and Microsoft released record third quarter results during the month, and Amazon rallied as revenues from their cloud business rose strongly. Whilst earnings continue to prove supportive, time will tell whether investors are complacent over the future earnings potential of the tech behemoths.

Despite a monthly gain of 4.1% seeing the FTSE hit a new record, domestic investors remain cautious and pulled £3.6 billion out of UK equity funds in the three months to the end of September. Is this just profit taking or pessimism over the domestic economic outlook ahead of this month’s budget?

The political change in Japan was welcomed by equity investors and the Topix rallied 6.2% in October, with a weakening yen providing support of exporters. However, the recent rally in Chinese equities faltered over concerns of an economic slowdown and the MSCI China index retreated by -3.8%.

Global bond markets showed little direction in October with uncertainty over future rate cuts, the Bloomberg Global Aggregate Index was down by 0.25%. The US ten-year treasury yield fell slightly, following another 0.25% rate cut – the yield is now 4.08% compared to 4.15% a month ago, whilst in Japan the equivalent JGB inched up slightly and now pays 1.66%. At home, despite the government borrowing £7.2 billion more than expected in the six months to the end of September, gilts were the best performing of major bond markets. The ten-year gilt rallied sharply last month from a starting yield of 4.7% to finish offering 4.41% as the Chancellor reassured investors that she would meet her fiscal rules.

Turning to commodities and gold saw another positive month although the 3% monthly gain masked significant volatility. An ounce of gold started the month at $3873 and hit an all-time high of $4359 during the month before seeing a 5% drop in one day and finishing October at $3996. Given the extended rally it is not surprising to see a pullback and a timely reminder of how sentiment can see significant fluctuations in the gold price.

Oil was also volatile in October with Trump’s sanctions against the Russian oil majors helping boost the price near the end of the month after dipping sharply on worries of oversupply. The price started at $67.02 a barrel, finished at $64.77 but fell as low as $61.01. There are some predictions of $50 a barrel in 2026.

In currency markets Sterling had a poor month against the dollar as markets got to grips with the chancellor’s pre budget problems and how to balance the books. Sterling fell 2.47% against the dollar. The pound also fell 0.46% against the Euro but rose almost 2% against the Yen.

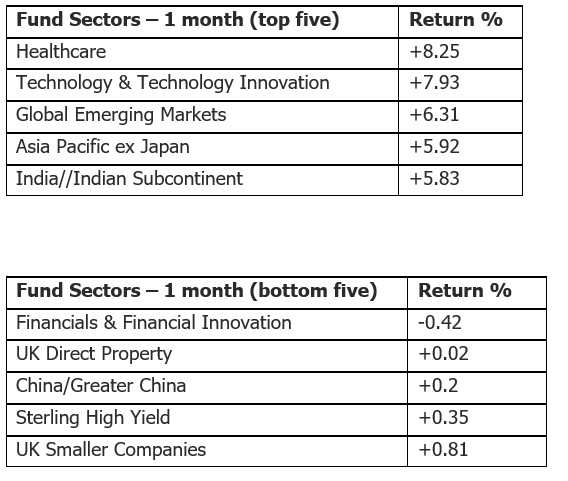

Looking at funds now and from a sector perspective Healthcare topped the charts with the average fund gaining 8.2%. M&A activity has continued the recent recovery for the sector and highlighted the value on offer – six of the ten best performers were biotech/healthcare funds.

Strong results from US Tech pushed the Tech sector into second spot with a gain of 7.9%. the remainder of the top five was taken up by Asia and Emerging Markets sectors as they responded positively to US rate cuts, trade tensions easing and more AI optimism. The foot of the tables had no real theme last month. Financial & Financial Innovation was the worst performer however it only fell 0.42% and was the only sector in negative territory last month.

The best performing funds were those invested in Korea with sentiment boosted by a potential truce in the tariff and trade war and further optimism around AI and semiconductors. Baring Korea gained 20.53% closely followed by JPM Korean Equity rising 20.13%. Korea’s strong performance and a rebound in Indian equities all helped push emerging markets higher as well with Macquarie’s Emerging Markets fund finishing in third place with a gain of 16.55%. The rest of the top ten was dominated by health and biotech funds.

Looking at the world of investment trusts and the Biotechnology sector topped the trust sector rankings last month with a gain of over 11%. Takeover activity in investment trusts has quietened down recently but the threat of corporate activity is clearly still a factor. Gore Street Energy Storage was the best performer gaining 24% last month but still sits on a near 40% discount to NAV – can this trust survive independently with activist shareholders pushing for change?

It often feels that professional and private investors take too much of a short-term view, so it is welcome to get some long-term perspective from JPMorgan’s annual report on Long-term Capital Market assumptions. In the report they identify three structural market themes. 1, A positive earnings outlook for global stocks as the technology narrative shifts from creators to users. 2, Bonds are providing a return bedrock of a portfolio once again with the best return outlook since the GFC for European sovereign bonds. 3, How USD weakness will have implications for unhedged returns and how they expect this to be a structural theme and see the dollar weakening significantly against Chinese and Japanese currencies.

The report also makes good observations that investors shouldn’t focus too much on Geopolitics, providing empirical evidence of the irrelevance of geopolitical shocks to long term returns.

N.b. the fund sectors exclude money market funds, markets are in local currency, and investment trusts exclude VCTs.

Important Information

This document is produced by Fairview Investing Ltd, an independent research consultancy. The content is for information purposes only and does not constitute financial advice. The commentary or research provided do not constitute a personal recommendation to deal. Any statements, opinions, forecasts, and figures are made by Fairview Investing (unless otherwise stated). They are considered to be reliable at the time of writing but may be subject to change.

Fairview Investing accepts no legal responsibility or liability for the content of this material. The contents of the document are not to be re-produced or circulated without the express permission of Fairview Investing Ltd. Fairview are independent investment consultants sitting on the Investment Committee of EXE Capital Management.